In November, I wrote about widespread fears of rising market rates and the related risks and rewards of adding duration to the cash and investment portfolio.

Since that time, community banker sentiment has only grown more worrisome with the market outlook for aggressive FOMC rate hikes. Last fall, the outlook for tighter monetary policy priced the December 2022 contract with close to a 100% probability of the funds rate peaking at 1.50%. Now, only 6-months later, the current market outlook is pricing in a 90% probability of the funds rate exceeding 2.00%! During that time, the 2-year UST rate has increased 200bps while the 5-year and 10-year UST rates have risen 150bps and 90bps, respectively.

Source: CNBC

The obvious question for those community banking institutions (CBIs) that extended cash is…"Did we make a mistake?” And for those who maintained their strong cash liquidity position in anticipation of more favorable investment opportunities, the question remains…"Should I wait for a further increase in rates?”

From the Editor

Buyer's Remorse

I recently had a conversation with a family member who completed their first home purchase. While showing me pictures of the new property, I couldn’t help but sense their relative lack of excitement.

They mentioned they had “cold feet” buying into a housing market that had appreciated in value by approximately 25% in the past couple of years. They were concerned about the potential for depreciation. They knew rates were moving higher and understood its impact on affordability and by extension housing values.

I told them that if they plan on living in that place for a significant number of years, then they would be paying down principal and therefore “insulating” themselves versus potential market “corrections”. More importantly, living in a single-family home is a more optimal arrangement than continuing to share a small apartment with a roommate!

It's hard not to draw parallels between this textbook case of “buyer's remorse" and that of the treasury function at community financial institutions. The specter of unrealized losses weighs on many individuals associated with the purchase of investments.

This Bulletin is “Part 2” of the popular November 2021 edition penned by Darnell Canada. The article focuses on the changes in the shape and level of the yield curve and its implications on the investment portfolio and balance sheets. Darnell does a terrific job quantifying the risk / return benefits of recent transactions to place proper context around the sometimes hotly debated topic of “unrealized losses.”

This is well worth the read for any organization currently exhibiting a case of buyer’s remorse!

Vin Clevenger, Managing Director

Did we make a mistake?

Before we help answer this question, it is important to remember that the industry tone on loan growth has been consistent with cautious optimism. Even for those institutions that experienced strong production/origination volumes, curtailments and pay-offs have restricted net growth for many CBIs. A direct consequence of this has been a contraction in loan pricing spreads. Operating with little flexibility to lower deposit costs further and pressure to reduce fees, bankers across the country continue to be faced with three alternatives to offset revenue pressures: 1) lower underwriting standards to facilitate growth, 2) increase the size of the investment portfolio, or 3) sit tight and maintain faith that loan growth prospects will eventually improve.

In the Fall Bulletin, I provided four key thoughts for consideration when determining whether to grow the investment portfolio and accept/tolerate the risk of unrealized losses associated with longer duration cash extension strategies.

1. Unrealized losses don’t affect regulatory capital, except in forced liquidation circumstances.

Conclusion = Concerns for impaired regulatory capital are misguided.

2. Most CBI balance sheets were asset sensitive, indicating that margin income would increase under rising rate conditions.

Conclusion = Added duration would not likely cause margin degradation but simply reduce the positive sensitivity delta versus flat rate margin/income expectations. In other words, reduced asset sensitivity (i.e., rising rate upside) will not translate into liability sensitivity (i.e., rising rate downside).

3. Yield curve slope is beneficial to investors considering cash extensions. The long duration strategy required less cash volume invested to generate the same income as the short duration strategy. Thus, there would remain more residual cash available to participate when market rates finally did begin to rise. Further, the greater relative price sensitivity of longer duration assets would be offset by the lower balance mark to market adjustment.

Conclusion = A steep yield curve can help temper both projected spread income and pricing risks.

4. Stock valuations historically trend inversely to CBI bond portfolio valuations because sustained high-rate conditions are associated with an expanding economy and increased growth opportunities, which augments the margin income benefits associated with a pre-existing asset sensitive posture.

Conclusion = Declining tangible equity ratios and economic value of equity (EVE) pre-shock values do not always lead to lower market caps for stock institutions.

In examining industry data, we can observe the following.

Yes. Unrealized losses have increased, as expected.

Market rates are higher, and the bonds purchased in 2020 and 2021 are likely being held at unrealized losses today. Call report data indicates that community banks (with assets between $500 million and $10 billion) increased investment portfolios by 35% in 2021. Portfolio market/fair values have declined on average 2% over the year. And as market rates have continue to shift upward since year-end 2021, portfolio depreciation has commensurately worsened.

Capital ratios remain strong.

While tangible capital ratios are slightly lower than observed last year (10% to 9.8%) for banks with assets between $500mm and $1 billion, the drop is more directly related to strong deposit growth in industry than unrealized losses in the investment portfolio. Growth in loans for banks with assets between $500mm and $1b grew minimally (1.5%). Meanwhile, tangible equity increased 8% over the year from average asset returns ranging between 1.25 – 1.50%.

At 10% of assets, leverage capital is double minimums required by “well-capitalized” statues. This suggests that CBIs are well postured to accommodate ongoing growth and absorb unanticipated hiccups in asset quality.

Balance sheets remain asset sensitive.

DCG runs close to 300 models each quarter and 10-12 distinct interest rate scenarios for each client, not including additional sensitivity stress scenarios.

At the onset of the COVID health crisis (4Q2019), our models indicated that approximately half the institutions in our universe had downside margin exposure to rising rate conditions (i.e., liability sensitivity), and therefore should have been cautious with managing asset duration.

The massive accumulation of COVID related liquidity in the banking system influenced a notable shift in interest rate risk postures during 2020, with approximately 85% of our modeling universe exhibiting asset sensitive characteristics in both +200bps and +400bps scenarios (shocks and ramps). More recently, after many CBIs began to extend cash into longer duration asset classes (loans and investments), our models still indicate that 75% still exhibit strong asset sensitive characteristics (+5-10% NII sensitivity). This means most CBIs should be optimistic about margin trends under rising/higher rate conditions and therefore, in a position to absorb any downside hits to these new longer duration assets.

Cash extensions have not muted upside performance potential for many CBIs. In fact, actual margin income outlooks are much less pessimistic in our interest rate risk models given current higher market conditions. The average 12-month projection for the Flat Rate Scenario in 4Q2020 models was -3.8%. Our most recent 1Q2022 models project a drop of only 0.9% in annualized Net Interest income levels in our modeling universe. This data confirms expectations that margin outlooks would benefit from higher rate conditions.

The negative impact of current higher rate conditions has been more meaningful to short duration assets.

If we examine the increase in market rates and the flatter yield curve that has developed over the past several months, we can determine that while pricing sensitivity is less so on the shorter end of the curve, the level of negative marks in short duration portfolios has been more meaningful given the larger volume of cash extension required to support projected revenue shortfalls.

In the example from the November Bulletin, we compared the projected income and price sensitivity of 3yr USTs (short duration surrogate) versus 7yr USTs (long duration surrogate). In that analysis, investors would have had to purchase 2.3 times the volume of 3yr USTs to generate the same income from the 7yr USTs. If we take the market rate adjustments that have materialized since that time, we can conclude that the investor in 3yr USTs would have been required to book an unrealized loss that is over 1.5 times that of the investor in the 7yr USTs today, placing greater pressure on tangible equity ratios.

Valuations are always a reflection of earnings outlook and strength in financial condition. The FOMC statement after its March meeting offered a clear indication that the Fed is confident in the strength and resilience of the US economy.

Despite an expectation for a dramatically higher funds rate, consensus viewpoints continue to be biased toward stronger growth. And strong economic growth leads to stronger revenue in the banking system. This is being reflected in stock valuations.

Should I wait for a further increase in rates?

Market expectations are for 200-300bps of FOMC rate hikes over the next 12-24 months. In contemplating investment strategy, be careful not to focus on the FOMC and short-term funds rate but rather medium/log term bond yields.

While the market is pricing in a fast and aggressive Fed rate hike cycle, it is also pricing in a reversal in 2024. This is reflected in the flat inverted shape of the yield curve (3-year UST rates are ABOVE 10-year UST rates). This yield curve shape suggests the market expects very little additional upward movement in medium/long term rates. If true, purchased yield opportunities may be at or near their peak.

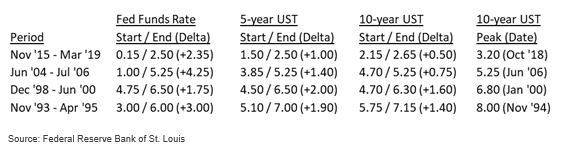

Historical data shows us that long rates start to rise before the FOMC begins to hike rates and, also peak earlier than the fed funds rate. In fact, long rates typically begin to DECLINE while the Fed is still hiking rates. Below is a chart illustrating the degree of yield curve flattening that occurred during the last four tightening cycles.

If we resist the temptation to be speculative with rates, the analysis below suggests that even if rates continue to rise, purchase yields would have to increase roughly 150bps to justify a longer holding period for cash liquidity. Assuming a purchase yield of 2.50% today and 200bps of fed funds rate hikes in 2022, purchase yields would have to be 4.00% 12-months from now to break-even on the income generated by the 2.50% investment over a 2-year earnings horizon.

Conclusion

Market timing is never a wise strategy and rarely works in the favor of financial institutions. As buy and hold investors, we find that the portfolio performance is optimal with a regular and consistent purchase strategy that modifies composition/mix based upon market and balance sheet conditions, including lending activity and available credit/liquidity spread opportunities.

In this regard, those CBIs that have remained active investors have benefited greatly. Those who remain on the sidelines might reconsider that tactic given the lost opportunity cost already realized and the narrative on outlook being scripted today by monetary policy makers and politicians across the globe.

Market rates are continually changing. The core principles of your investment strategy should remain the same. Minimize speculation. Stay active. And emphasize portfolio fit with risks embedded in the core lending and deposit function. Do this and seldom will you observe meaningful damage when looking in the rear-view mirror.

Learn more about our Asset/Liability Management services.

ABOUT THE AUTHOR

Darnell Canada is a Managing Director for Darling Consulting Group. Darnell works directly with C-suite executives helping them to understand the complexities of their balance sheet financial risks and providing guidance and unbiased advice on strategies that strengthen earnings performance. In addition to providing advice for margin improvement and risk mitigation, he helps financial institutions manage through the rigors of challenging regulatory situations.

© 2022 Darling Consulting Group, Inc.

Comments